At Tax Mechanic, we’ve analyzed the new framework in depth. Below, we break down exactly what is changing, what relief is available, and how taxpayers can best prepare.

On October 1, 2025, the Canada Revenue Agency (CRA) will implement sweeping updates to the Voluntary Disclosures Program (VDP). These changes are designed to make the program more accessible, less restrictive, and clearer for Canadians who need to correct past tax errors or omissions.

Why the VDP Matters

The VDP provides individuals and businesses with a chance to voluntarily come forward and fix tax filing errors before the CRA enforces compliance. In return, applicants can often avoid penalties and reduce interest charges.

The 2025 reforms show that the CRA wants to encourage early disclosure while still being tough on serious non-compliance.

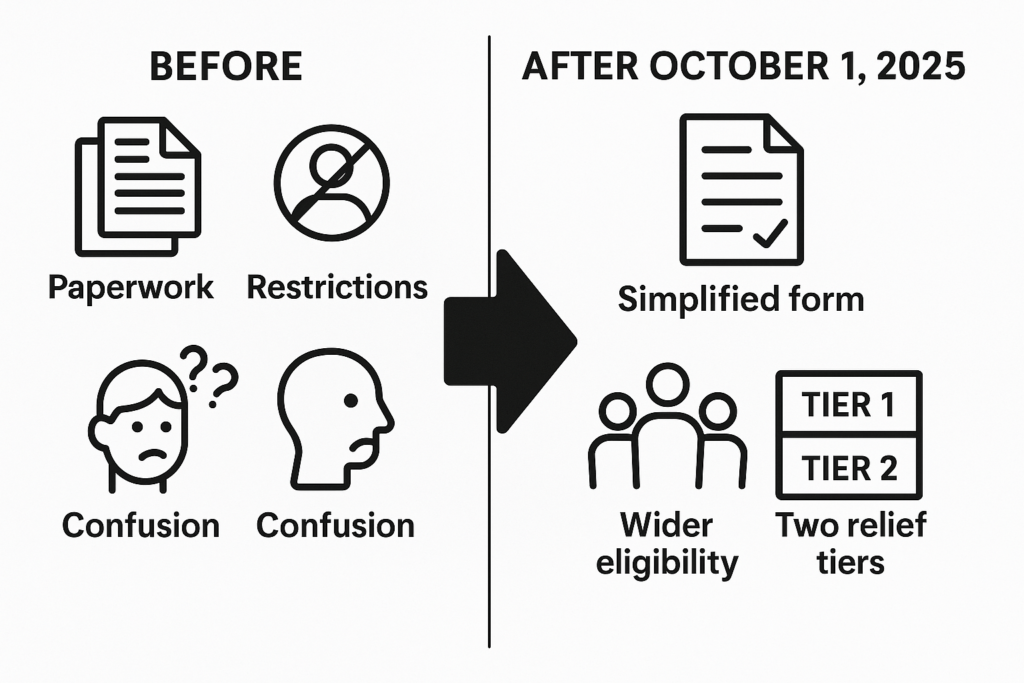

Key Changes at a Glance

| Feature | Before (Applications prior to Oct 1, 2025) | After (Applications on/after Oct 1, 2025) |

|---|---|---|

| Application Form | Form RC199 lengthy and complex | Form RC199 simplified and user-friendly |

| Eligibility | Excluded if contacted about non-compliance | Eligible even if contacted (educational letters) |

| Audit/Investigation | Still ineligible | Still ineligible |

| Relief | One-size relief | Two tiers: • General Relief (75% interest relief, 100% penalties) • Partial Relief (25% interest relief, up to 100% penalties) |

| Required Years | Not clearly defined | Foreign income/assets: 10 years Canadian income/assets: 6 years GST/HST: 4 years |

| Extra Documentation | Case-by-case | CRA may still request more years if needed |

Key Highlights of the New Rules

1. Simplified Application Process

- Form RC199 will be redesigned for clarity and ease of use.

- Less paperwork, faster filing.

2. Increased Eligibility

- Taxpayers who receive educational letters about unreported income or ineligible expenses remain eligible.

- Still excluded: those under audit, investigation, or with egregious non-compliance.

3. Two Relief Tiers

- General Relief (unprompted applications):

- 75% relief on applicable interest

- 100% relief on penalties

- Partial Relief (prompted applications):

- 25% relief on applicable interest

- Up to 100% relief on penalties

4. Clearer Documentation Rules

- Foreign income/assets: 10 years

- Canadian income/assets: 6 years

- GST/HST: 4 years

- No need to include years without errors — unless CRA asks for them.

Why Timing is Critical

The difference between general relief and partial relief could mean thousands of dollars saved. The earlier you disclose, the greater the benefit.

👉 Submitting before CRA contacts you ensures you fall under the general relief tier.

How Tax Mechanic Can Help

At Tax Mechanic, we are specialists in:

- Voluntary disclosures

- CRA negotiations

- Audit defense strategies

We ensure that every application is complete, strategic, and compliant, maximizing relief and protecting you from unnecessary penalties.

📞 Contact us today for a confidential consultation and let us help you take advantage of the new VDP framework.

Final Thoughts

The CRA’s revised Voluntary Disclosures Program strikes a balance between leniency and enforcement. For taxpayers, this is a chance to reset compliance while benefiting from significant interest and penalty relief.

With the deadline approaching, the smartest move is to act before October 1, 2025. The sooner you disclose, the more relief you can secure.